Recently I read a very thorough analysis of long term commodity prices from one of my favorite strategists which prompted my thinking about natural resources. I ask the question and seek to answer if we’ve entered a new paradigm when it comes to world natural resource use and distribution? This basic premise has to do with population growth, the rise of China and India and their consumption of resources at a scale the world has never known, sitting on top of the developed world’s continued use of materials and resources.

For instance, as of 2010 China’s share of global consumption was:

Cement 53.2%

Iron Ore 47.7%

Coal 46.9%

Pork 46.4%

Steel 45.4%

Lead 44.6%

Zinc 41.3%

Aluminum 40.6%

And the list goes on as the world’s second largest economy continues to grow unabated…..

Using oil as a data-point, from 1878 until 1971 oil hovered about $16/barrel +/- a small amount in today’s dollars. However, from 1971 to the present, it rose precipitously and today it is not only at record levels, but has moved 6 standard deviation above $16 in today’s dollar terms. Brent Crude closed at $117.52 just this afternoon. With so many other commodities performing the same way, is this demonstrative of a paradigm shift in global natural resource supply and demand? To put a nail in the coffin on this idea, since 1994, one has to dig up an extra 50% of ore to get the same tonne of copper and this 150% effort has to be done using energy at 2 to 4 times the former price.

I read Jim Roger’s book, “Investment Biker” in 1997. He had finished a motorcycle ride around the world and much of that book is a mini-summary of global economics. He was the first person I heard, talk about the coming commodity boom and his visits to many developing countries during this trip convinced him the world would soon be needing tremendous amounts of raw materials. We are seeing this come to pass.

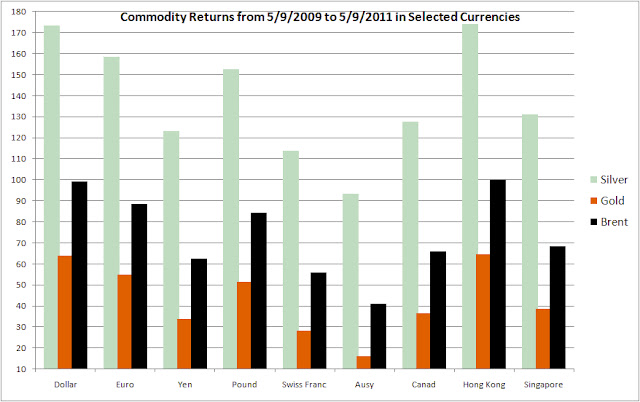

For the U.S., the purchasing power of the dollar continues to fall, especially relative to other currencies. The following chart shows the return of Silver, Gold and Brent Crude from May of 2009 until now in various currencies. Hong Kong currency represents the Yuan in this plot since the HKD is pegged to the dollar. Notice however that measured in Swiss Francs, Australian and Canadian dollars, the appreciation of these three commodities hasn’t been nearly as severe as compared to what U.S. dollar consumers are paying (or earning on these commodity investments). Is the fall of the dollar inviting demand for commodities as a hedge?

This run-up in prices hasn’t been missed and just before the credit crises of 2008 began, speculators took the media’s blame for the huge price increases even though the CFTC’s Interagency Task Force’s July 2008 Report on Crude Oil said:

The Task Force’s preliminary assessment is that current oil prices and the increase in oil prices between January 2003 and June 2008 are largely due to fundamental supply and demand factors. During this same period, activity on the crude oil futures market – as measured by the number of contracts outstanding, trading activity, and the number of traders – has increased significantly. While these increases broadly coincided with the run-up in crude oil prices, the Task Force’s preliminary analysis to date does not support the proposition that speculative activity has systematically driven changes in oil prices.

There have been other reports offering the same vindication that the fundamentals of supply and demand are changing such that price rises of commodities are due to shortages. Currently corn stockpiles are at decade lows. How can this have any other impact then that corn futures must rise, especially when growing middle class consumers in China, Indian, Vietnam and Indonesia are hungering for more (historically) western styled foodstuffs?

The next chart documents commodity index price rises in energy, petroleum, industrial and precious metals, agriculture, livestock and softgoods. Never before has the correlation across varying commodities been so high (i.e. all commodities moving lock-step in one direction, up!) other than during WWI and WWII’s when shortages abounded on a global scale. Fortunately we’re not in a global war, but the cause is likely the same, global shortages of commodities.

Another point of reckoning has to do with the much larger availability of commodity ETF’s and mutual funds which are allowing the retail investor to participate in this asset class, where a decade ago, one had to buy physicals with ensuing storage problems or futures, both difficult for the retail market to handle. In addition, the emergence of pension funds and institutional asset managers to make commodities part of their holdings too give’s credibility to the bull market in commodities as well as helps to keep prices higher by creating demand for the asset class. Nevertheless, the demand whatever the cause means there’s more reason for commodities prices to continue to rise until this demand can be met. The question I’m having a hard time answering is, will it?

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.