The roots of value investing can be traced back to the 1934 publication of Benjamin Graham and David Dodd’s classic, Security Analysis. Graham later disseminated his views to the general public in the highly regarded book The Intelligent Investor. The influence of Graham’s methodology is indisputable. His disciples represent a virtual who’s who of value investors, including Warren Buffett, Bill Ruane, and Walter Schloss. As a measure of his enduring impact on the field, a search of “Benjamin Graham” on Amazon.com yields more than 900 results concerning Graham’s writings and works about his investment philosophy. Given the success of the master and his students, it is no wonder that Graham remains an investor of immense interest to practitioners.

The title Ben Graham Was a Quant: Raising the IQ of the Intelligent Investor will probably cause readers to envision a book that traces Graham’s remarkable life and dissects his use of quantitative techniques that have become prevalent in modern finance. In reality, Steven P. Greiner has written a very different type of book. Greiner, the head of Risk Research for FactSet Research Systems, is the stereotypical Wall Street quant, holding a bachelor’s degree in mathematics and chemistry from the University of Buffalo and a PhD in physical chemistry from the University of Rochester. Greiner’s background in the hard sciences is evident in the quotations from either Albert Einstein or Isaac Newton at the beginning of nearly every chapter and in the author’s extensive use of examples from the hard sciences.

Throughout the book, Greiner pays homage to Graham, using his investment philosophy as the catalyst for examining quantitative investing. In the early chapters of the book, however, Greiner focuses mostly on his own view of quantitative investing. In spite of his strong quantitative background, he does a good job of making his ideas accessible to readers with a wide variety of backgrounds.

Greiner starts with a review of the history of quantitative investing. In most accounts, the story begins with Harry Markowitz’s seminal work on portfolio theory in 1952. For Greiner, however, the origins of quantitative investing date back earlier, to the work of Benjamin Graham. Greiner points out that Graham’s 1949 classic,The Intelligent Investor, lists seven criteria that defined the “quantitatively tested portfolio.” These criteria include such factors as the size of the enterprise, earnings stability, financial condition, dividend record, earnings growth, price-to-earnings ratio, and price-to-book ratio. As Greiner points out, the definition of a quant as someone who designs and implements mathematical models for the pricing of securities does not mention the use of a computer.

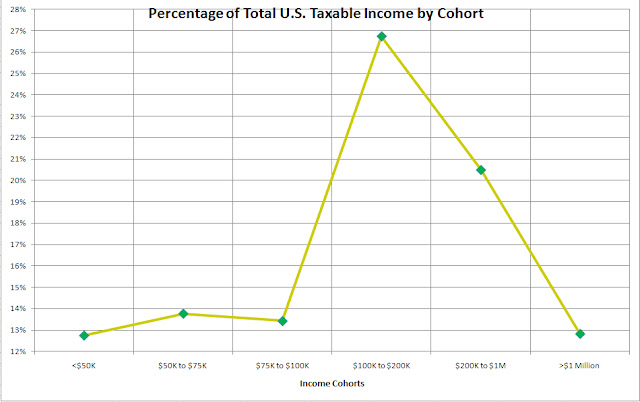

As the pages go by, the link between Graham’s methodology and quantitative analysis becomes clearer. Chapters 4–6 begin to delve into the quantitative factors that Graham used in formulating his investment philosophy. Throughout these chapters, Greiner tests the empirical validity of Graham’s factors with a Fama–French type of model. Greiner criticizes the factors used by many MBAs that are linked to academic theories but may have no empirical validity. He writes, “Empiricism suggests the main drivers of stock returns are often market trading forces more than business financials.” In testing Graham’s model, Greiner finds that such factors as book-to-price ratio, price-to-earnings ratio, and dividend yield do extremely well in predicting performance.

Using the Graham factors, Greiner goes on to build a factor model for predicting returns. Because he cannot confer with Graham on which factors to include in the model, Greiner does not use stepwise regression to identify the best ones. Rather, he elects to use all the factors in order to remain true to the Graham methodology. Throughout the book, Greiner provides numerous tables and graphs to document the effectiveness of the Graham factors in predicting security returns and to support the fundamental tenet of the book—that empiricism should trump theory in modeling security returns.

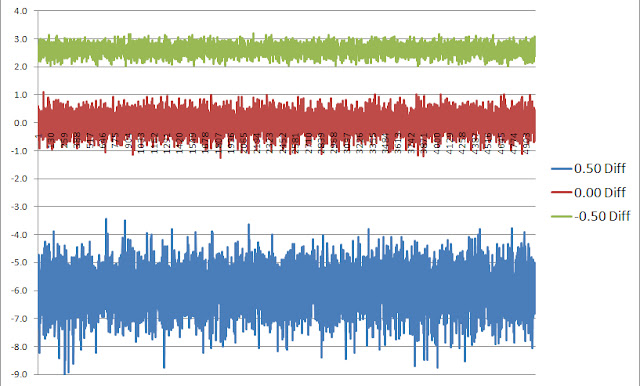

Greiner saves the most technical material for the end. Stochastic portfolio theory is introduced in Chapter 9 as an alternative to the modern portfolio theory traditionally taught in graduate schools. Greiner begins with an example of fractals to introduce the reader to the concept of scaling and then moves into the area of stochastic modeling and the Ito equation. Breaking the Ito equation down into two components, drift and variance, allows Greiner to show when to favor different investment methodologies. If the drift component dominates the variance component, then momentum investing (i.e., the Graham method) will produce solid returns. If the variance component dominates the drift component, then contrarian strategies will work well.

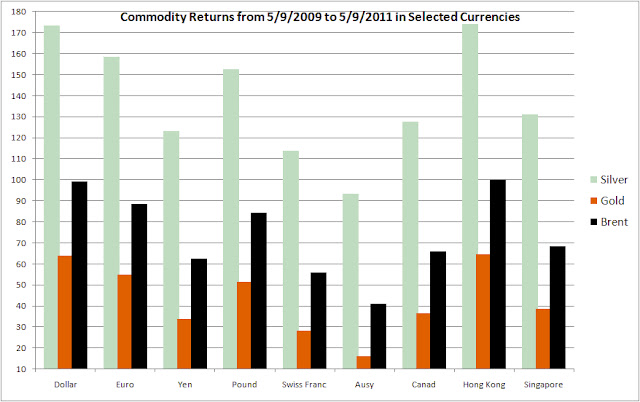

The book ends with a digression that is part history, part political commentary, and part foreshadowing of what is to come. Not surprisingly, Greiner provides evidence from the hard sciences on the importance of using empiricism to support theory. He begins the final chapter with a discussion of the theories of gravity devised by Newton and Einstein and the solar eclipse in 1919 that allowed researchers to empirically verify Einstein’s calculation. The inability of modern portfolio theory to explain the internet bubble of 1999–2000 again provides Greiner with the impetus to search elsewhere for new and empirically relevant models. Although few have been able to predict bubbles, Greiner finds a French physicist, Didier Sornette, whose model has been remarkably accurate in predicting them. Sornette’s work leads to a prediction of a market bubble in China, which motivates a discussion of the Chinese economy and its long-run impact on the U.S. economy. Greiner examines the financial crisis in the United States and then provides an un-quant-like discussion of the complicity of the U.S. government in causing the crisis. Greiner concludes with a discussion of the future of quantitative investing. He suggests that numbers may be replaced by qualitative information that can be used to create quantitative measures and advises aspiring quants to study Chinese, physics, and statistics to deal with this new world order.

Although his title is a bit misleading, Greiner has produced a well-written book. Despite being somewhat disjointed, it makes effective use of Benjamin Graham’s investment methodology to introduce such concepts as alpha, the Sharpe ratio, and the Fama–French model. His ability to describe quantitative techniques without overusing difficult esoteric equations allows those with more modest mathematical sophistication to access the concepts used by quants. All in all,Ben Graham Was a Quant is a rewarding read for those who desire a glimpse into the world of quant investing.

—R.L.M.