We heard recently that even the old sage of Omaha is recommending that we raise taxes on his buddies, that is, the truly rich. Well first, Mr. Buffet makes most of his income from his investments, not salary. In which case, his income has already been taxed twice since it comes from dividends and capital gains which are taxed at 15%, after these monies have already been taxed at the corporate rate of 35% before distribution, hence the overall tax rate on these monies is approaching more like 40% to 45%. This double taxation is a competitive disadvantage to U.S corporations as few other countries employ this tactic, let alone tax monies earned overseas and left there too.

Nevertheless to enter this debate, we must first realize that President Obama wants to increase income taxes on those making $200,000 or more a year, not just on those who are multi-millionaires and billionaires. So let’s ask the question, just who are these people with above average earnings, but not truly rich? We can download from the IRS website (http://www.irs.gov/taxstats/indtaxstats/html) almost any kind of tax data we want, so from the IRS Statistics of Income 2011 we can tabulate some interesting data for 2009, as the data compilation is two years in arrears. The table below has in it all we need to describe these “criminals” we need to tax more from.

Nevertheless to enter this debate, we must first realize that President Obama wants to increase income taxes on those making $200,000 or more a year, not just on those who are multi-millionaires and billionaires. So let’s ask the question, just who are these people with above average earnings, but not truly rich? We can download from the IRS website (http://www.irs.gov/taxstats/indtaxstats/html) almost any kind of tax data we want, so from the IRS Statistics of Income 2011 we can tabulate some interesting data for 2009, as the data compilation is two years in arrears. The table below has in it all we need to describe these “criminals” we need to tax more from.

In this chart we show on the first column the income categories followed by the number of filed returns, the amount of income for each cohort and the percentage of income of the total these categories compile. These are all highlighted in green. Toward the bottom of the chart we approach the truly rich, the millionaires and multi-millionaires. So those “criminals” who earn $10 million or more a year, they take home 4.2% of all U.S. income but compile just 0.01% of the population. Mr. Buffet falls into this category.

However, in brown we highlight their tax liability and payments. Those same people, those criminals who earn that much money, already pay 26.3% of all income tax (2nd column from right). In addition, they only pay over $6 million each! They’re criminals anyway so we should just confiscate all of their income! I hope you see my sarcasm.

The question that needs to be asked, is “what is the rich’s fair share?” Seriously if you think about it, if ~30% of the bulk of U.S. income tax paid by the rich isn’t fair, what should it be? From these tables, the rich already pay more than the rest of us so what I ask is, what’s fair? The truly rich comprise 0.01% of the population, have 4.2% of the income and pay 6.2% of all income tax while paying 26.3% of their income in tax individually. Contrast that with those earning between $75K and $100K who comprise 13.4% of the population, earn 13.4% of all income and pay 9.3% of total U.S. income tax but only 12.3% of their income in tax personally. Further, those earning between $30K and $40K comprise 11.7% of the population, earn 4.16% of total U.S. income and contribute just 2.33% of all tax while paying 10% of their income in tax.

Oh, by the way, we’re such a polite society, we can see that those who earn between $20,000 and $25,000 a year pay 8.7% of their income in taxes individually, while comprising 5.6% of the population and earning 0.78% of U.S. total income. But when we really want to know who pays the most tax, the IRS informs us, it is those who earn between $200,000 and $10 million, they pay almost a full one-third of their income in taxes and contribute 29.1% of ALL U.S. INCOME TAX receipts.

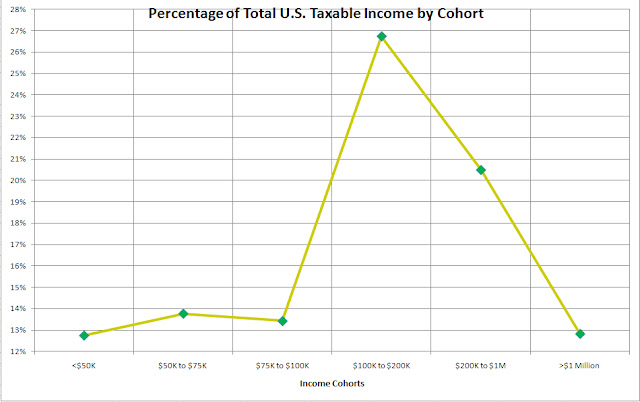

Now, another way to look at this data is to remove the granularity which we show in this next plot of the percentage of U.S. income by just six categories of income. This is the chart below.

Here we can exactly why President Obama wants to increase the taxes on those earning $200,000 a year and that reason is because that’s where the money is. From this chart, almost 27% of all income is between those making $100K to $200K and over 20% earn between $200K to $1Million dollars a year. Just like the outlaw Jesse James who robbed banks because that’s where the money is, so our tax policy is moving in the same direction. But are those earning $100K the rich? Hardly.

From the data the IRS so politely made available, we can delve in and plot a bar-chart of the % of taxable income (green) and % of tax paid as a function of income (red bar). The next chart illustrates this very well. From this dataset, we can see that the majority of Americans earn between ~$75,000 and $500,000 a year. That is where the bulk of the green bars demonstrate the highest percentage of tax payers income is from. In essence then, this defines the 2009 middle class. First, it’s unbelievable to me that a family earning $350,000 a year for instance is in the middle class these days, but that’s what the data says. If your income is in the middle of the data, you’re middle class. A reason for this is due to the devaluation of the U.S. dollar so that $350,000 a year today is more like $150,000 in 1995. It’s just not a lot of money anymore when a regular, not a fancy house, costs more than that today in most major cities.

However from this data set, look at where the majority of taxes come from? This is seen by the tall red bars beginning on the right side of the chart. Notice that beginning at $500,000 a year in income, the percentage of tax paid moves from 15%-16% of income to over 24% and it increases from there. The huge majority of total U.S. income tax is born already by the “rich”. If in this country you’re lucky enough to make an income above the middle class, you also obtain the right to pay the majority of the tax. It’s a great deal for the rest of us on the bottom of the income scale!

When we begin to ask, “it’s a great deal for whom?” We can answer that with a clip obtained from recent a WSJ editorial shown below.

As we already “soak the rich”, the payout to those on the left side of these charts, those on the lower income side of the equation also receive more and more of these taxes in entitlements and such. In essence the transfer and redistribution of wealth already occurs in this country using the existing tax policies, let alone the new taxes the government wants to impose on us all. If you’re middle class, watch your pocket book and the best way to do that is to pay attention to those you’re voting for.