From time to time people say to me, aren’t you concerned about the Chinese exploiting the factory laborers like they are, paying them “slave” wages? Now, in all honesty, most of these off-hand remarks are from Americans whose worldviews and experiences are U.S. centric simply due to their home bias. However, it’s time to put some information together to reveal how unaware these comments are of the true situation in the Far East.

To begin, inflation is quite rampant in China, India, Singapore, Thailand, Vietnam, South Korea, Malaysia, Hong Kong, Indonesia and many other emerging markets. Food prices, not to mention oil prices are having a huge impact on these parts of the world and as most of you know, these are crowded countries so there’s not much more land available for farming. So, this results in inflation in these countries across most goods and services. Inflation is not only coming from the demand side, but also from the supply side for food and other commodities, not to mention oil. The chart below from the IMF puts these numbers in perspective. There’s no doubt prices across the globe are spiraling.

In particular unemployment is below 4% for Malaysia, Thailand, Singapore, Hong Kong and South Korea. Industrial capacity is also above historical averages for these nations so that by most standards of economic measures, Asia is back to where it was before the global credit crisis hit in 2008. So what will these nations do to combat inflation and what is the impact on these country’s economies due to these consumer price rises?

Well, to begin, fallout from rising prices puts pressure on businesses. Given these low unemployment rates in the Far East, there are labor shortages beginning to occur. Finding employees is becoming difficult and second, even if unemployment wasn’t low, rising prices means wages need to rise to subvert social unrest, an obvious issue for the Chinese for instance. Singapore has a long history of immigrant labor and the shortage these days means that employees can switch jobs and get 20% to 30% raises just for the taking a new position. The World Bank says Thailand raised the minimum wage 6% last year alone and is claiming labor shortages of over 100,000 for workers. The same thing is occurring in Malaysia. In China we’ve seen strikes and work stoppages because employees are demanding wage increases and the good news is, they’re getting them.

The usual prerogative falls on the central banks and they will (and are) raising interest rates to try to choke-off the rising prices but generally, these rising prices are destructive and are straining industrial capacity and labor. It’s making it very good for job hunters and many native born Chinese and Indians studying abroad for instance are going back home rather than staying in their host country after graduation like they have in times past. Moreover, much of the immigrant labor from countries like Bangladesh and Indonesia that offer supply, are finding more opportunities at home. So demand for labor is increasing while supply is falling leaving wage increases happening in order to in order to close the gap.

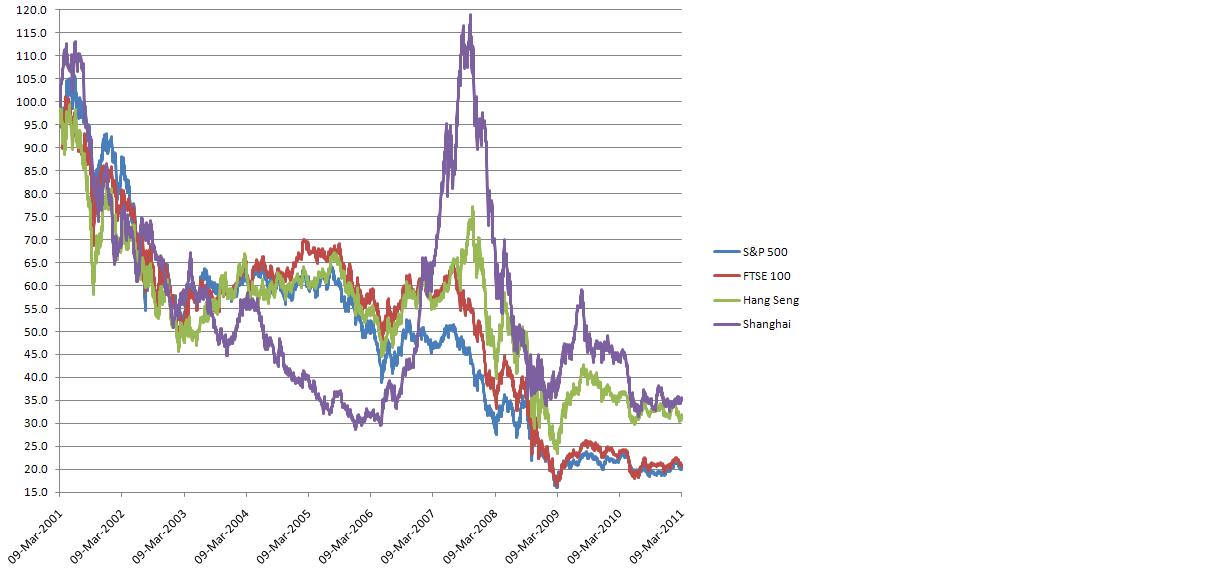

Unfortunately, these rising prices across global commodities combined with the developed Western world’s central banks quantitative easing as it’s called, which means printing currency effectively, is eroding the West’s standard of living and in fact debasing the currencies of these countries. In fact the next chart illustrates this by showing the major stock indexes of the world priced not in their underlying currency, but in the currency of the commodity basket of the Reuters-CRB index prices.

One of the considerations the governments in the developed world (U.S. Eurozone and Japan) have is how to pay the interest on their burgeoning debt. One way, is to print money in so doing, devaluing the major currencies of the world relative to oil and gold and other commodities. This is evident when you describe the stock market indexes in terms of underlying commodities prices versus fiat currencies.

The chart below prices the indexes over the last decade in Gold. The run-up in Gold prices in essence is associated with the loss of confidence in fiat currencies. It’s not just commodity demand that is causing prices of commodities to rise, but also this loss in trust of major developed world currencies due to the size of most developed world debt.

This chart above shows the last decade of the S&P500, FTSE 100, Hang Seng and Shanghai stock indexes, priced in Gold rather than U.S. dollars, British pounds, Hong Kong and Chinese currency respectively. The HK and Chinese currencies are pegged to the U.S. for the most part, but lately the Chinese Yuan has been rising slowly relative to the dollar. The data here is also normalized so that all indexes fit on the same scale, but this does not affect their trends which is collectively downward. The Shanghai stock market bubble is quite evident at the height of the global credit crisis in 2008 however, but the main trend is clear, relative to gold, the earnings power of currencies is decaying. In spite of the dollar’s short term gains against other currencies recently (not shown), the global purchasing power of currencies is falling. Only the Australian and Canadian dollars are holding there own these days, and that can be tied to their huge natural resource exporting economies (i.e. commodities).

The takeaway from these plots is like we’ve said before, fiat currencies are losing their value relative to materials and commodities. The buying power of currencies is dropping worldwide. This occurs along with the natural rise in inflation in the Far East due to the huge and growing demand for consumer goods and Western style food as these economies arrive into developed nation status. Moreover, it puts pressure on wages in these countries and allows for job growth to spur considerably faster than in the developed world, which will have a long and possibly unresolved economic hangover due to the very large government debts these nations are running and not dealing with in a truly effective manner.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.